HOW THE HIGH-NET-WORTH ARE INVESTING IN TODAY’S MARKET

Share on Social

Montreal TIGER 21 Chair John Koloda highlights the key findings of the recently-released TIGER 21 Asset Allocation Report in The Globe and Mail.

The following topics were covered:

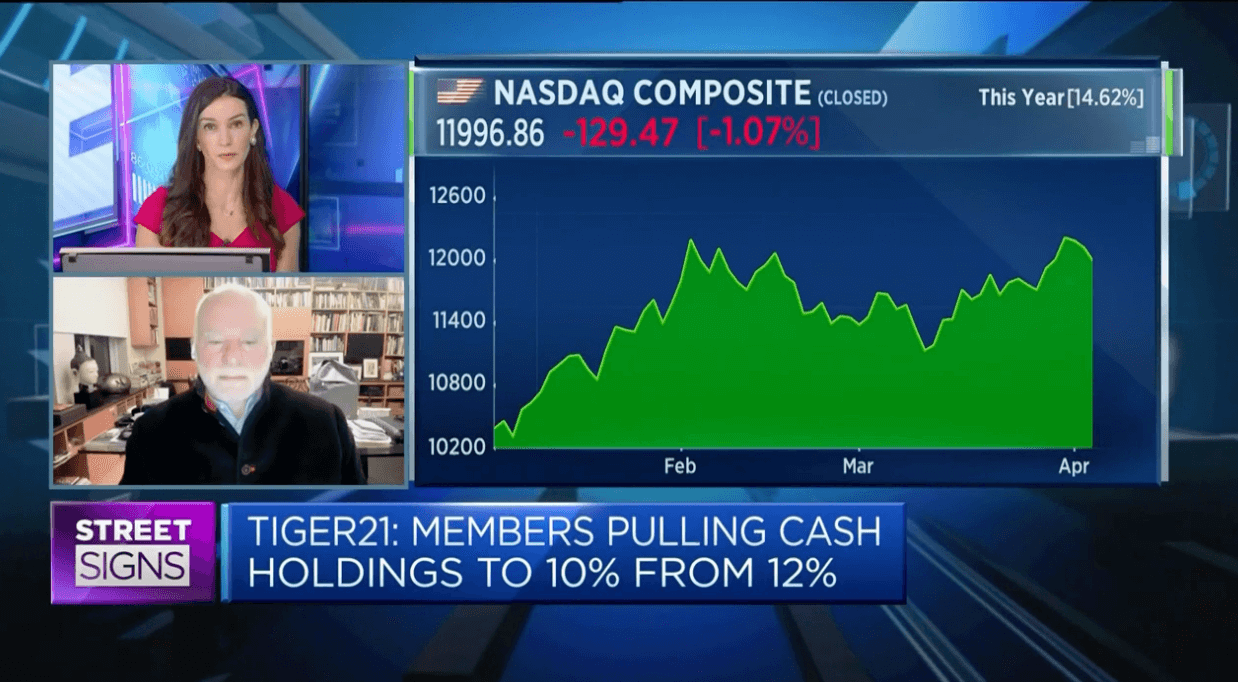

- Cash holdings remained steady with an allocation of 12%, a relatively high allocation based on trends of the last decade.

- Allocations to Real Estate have been bouncing back starting last quarter — a shift from the decreased exposure experienced for the prior three quarters. In Canada, and particularly in Montreal, Members remain optimistic about strategic opportunities across residential, commercial as well as industrial Real Estate.

- At an allocation of 23%, Private Equity is at its lowest level since the second quarter of 2018, but still above historic levels. In Montreal, there is a myriad of private equity opportunities available as the city becomes firmly established as an artificial intelligence hub.

Click here to read the full article.

Scroll down to complete the form below and receive the most recent TIGER 21 Asset Allocation Report

About TIGER 21

TIGER 21 is the premier peer network helping HNWIs and family offices navigate the challenges and opportunities that success creates. Lorem ipsum dolor sit amet, consectetur adipiscing elit. Nulla sed nisl quis quam vestibulum consectetur. Ut semper pulvinar libero vel semper.

Explore the TIGER 21 Member ExperienceMember Insight Reports