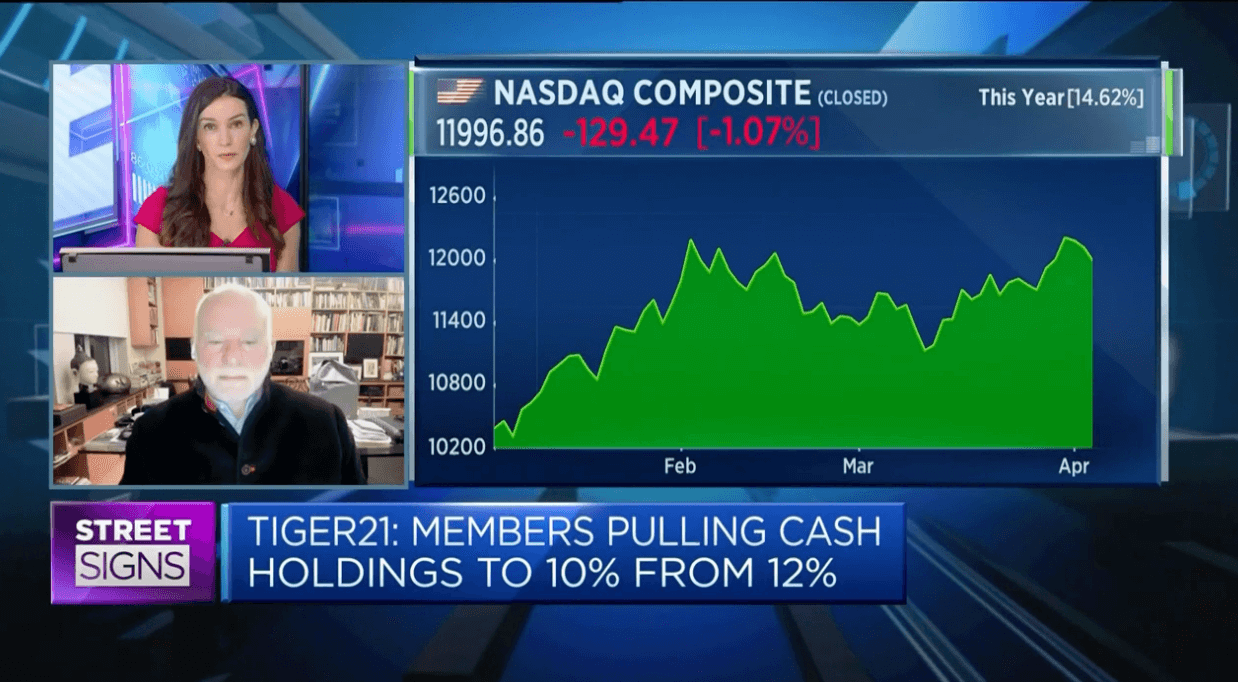

THE ULTRA-WEALTHY ARE RAISING CASH TO NEW LEVELS | MARKETWATCH

TIGER 21 Founder and President, Michael Sonnenfeldt, discussed the TIGER 21 Asset Allocation Report with MarketWatch.

The following topics were covered:

- The Group’s total allocation to cash levels that have not been seen since the start of 2013.

- Private equity remains preferred over public equity – 25% vs. 22% – reflecting the “edge” that TIGER 21 Members feel they get when investing directly in small companies.

- Sonnenfeldt points out that TIGER 21 Members have one foot on “the brake because of concerns about expansion becoming a little long in the tooth” and “one foot on the gas because of a long-term optimism about the economy.”

Click here to read the full article.

Scroll down to receive the most recent TIGER 21 Asset Allocation Report

Recent TIGER 21 Insights you might be interested in:

TIGER 21 Founder Tells CNBC.com Why Members are Ramping up on this Asset

TIGER 21 Founder Discusses on CNBC the Asset Allocation of the Ultra-Wealthy

What I Learned at the 2019 Berkshire Hathaway Annual Shareholders Meeting

About TIGER 21

TIGER 21 is the premier peer network helping HNWIs and family offices navigate the challenges and opportunities that success creates. Lorem ipsum dolor sit amet, consectetur adipiscing elit. Nulla sed nisl quis quam vestibulum consectetur. Ut semper pulvinar libero vel semper.

Explore the TIGER 21 Member ExperienceMember Insight Reports